25 Years of Lean Car Retail Research

Introduction

This year is the 25th anniversary of our applying lean thinking to car retail research. In this article I reflect on some of the key learnings and the challenges ahead. Such reflection is poignant because we were delighted to have lean car retail pioneers Pedro Simao, Torgeir Halvorsen and Sharon Visser at our recent UK Lean Summit. It was great to see them and catch up on the current challenges faced in automotive retail.

As background, Dan’s interest in taking lean ideas from manufacturing into car retail, sales and service was triggered by The Machine that Changed the World. The ideas were explored further when several participants of that research set up The International Car Distribution Programme. ICDP’s work on car distribution became particularly influential. In parallel, work to understand Toyota’s Parts Distribution System (to their dealers) provided another valuable input as it was possible to deliver exactly the right parts with much less effort and one tenth of the inventories traditionally held.

To build on these pieces of work in automotive, we took the next logical step of understanding if lean could also be applied to the car dealer. Dan asked John Kiff and I if we would conduct some research through experiments. We started working with a number of lean dealer pioneers. In 2005 we published a workbook, Creating Lean Dealers, as a how to guide. Since then, I have always had one car dealer in a specific market that I’ve worked with in depth on lean car retail. This blog post is a reflection about the learning at each stage of this journey.

Early Lean car Retail Research

Contextually, one needs to remember when we started. In 1998, lean research was just beginning beyond manufacturing. My background was manufacturing, so I tried to “find” the physical process that existed in the dealer. It’s always easiest to think about lean application where one can see the work. This led us to start with body repair. Although this isn’t a core dealer activity, we wanted to maximise our chances of success and demonstrate the capabilities of lean.

Lean in Body Repair

Body repair is not so much an assembly process, but a disassembly process, followed by a repair, some paint and some re-assembly. Lead times are long when compared to the value creating time and, in larger facilities, vehicles move through the process steps with queues in between. A perfect candidate for flow.

Our first “research partner” was a regional dealer group mainly focussed on VW Group product. It was run by the daughter of the founder who had been recognised as an up and coming owner by manufacturer management. From the outside, the company was very people focussed. The team also had an extremely personable and charismatic MD. A doer who would roll his sleeves up. Both MD and owner were extremely likeable and approachable. What could go wrong?!!!

The reality was, not a lot. The first body shop was having a refurbishment. We taught the team 5S and the MD and I went during the weekend to sort and set in order all the key equipment and tools. The company had organised itself with working team leaders who took to such a practical process brilliantly. They questioned industry norms, such as technicians having their own tools, and duly produced simple shadow boards and trolleys that make a dramatic improvement to productivity. Then, as now, it is just about making the work easier for everyone. At the same time, they reorganised their estimating process, measuring the estimate accuracy. This dramatically improved the flow, compressing lead times, reducing rework and improving quality.

Completing our initial research

Senior management could measure the benefits. The team could feel the benefits. Management engages their front-line teams to make improvements in the work. Result: Improvement happens. However, as we began to think about how to expand the process, the personable and charismatic MD left to move North. A new MD came from a large dealer group and things changed. Towards the end of the month, we prioritize moving ahead with work that can be completed (invoiced) by the end of the month over older work that cannot. The flow and pull system falls over. Parts aren’t available and team members feel undermined. They realise this is impacting their ability to deliver on time to all customers.

Elsewhere it’s worse as 1990’s dealer group management practices replace simple lean thinking. Our research period ends. We haven’t created a lean dealer, but we have shown the potential of lean car retail. We publish our research.

As a footnote, some-time later the traditional MD is found out. The charismatic MD returns but eventually they sell the business…

Reflections

- There are potential benefits in all lean implementations.

- The success came from engaging the front-line.

- The problems came from senior and middle managers.

- We focussed on improving Quality, Delivery and Cost – Customer value.

- To do that we focussed on the work. The link is clear for lean thinkers, but not clear for traditional thinkers.

- There was no way to agree “purpose” for the dealer. Therefore, it was difficult to define what value for the customer is.

Lean Dealer Research is Published

We published the first lean car retail research at a conference called “Future of the Dealer” in Lisbon in 1999. As is typical of such events, a few people came up to ask questions at the end. One of those was Pedro Simao. He studied Engineering but ran a dealer group established by his father in Oporto. The group was multi-brand. I was invited to spend a week with his team and designed a series of exercises to help them put theory into practice. The initial exchange appears in Lean Solutions pp. 81-86. The key activities were as follows:

- We mapped a value stream.

- Discussed customer fulfilment (right first time, on time) as a better customer measure than customer satisfaction.

- We followed a car through after sales to see the waste in the material and information flow and agreed a set of next steps.

All in 3 days! And we went to a Champions League game and a special stage of the Rally of Portugal. It was a busy week!

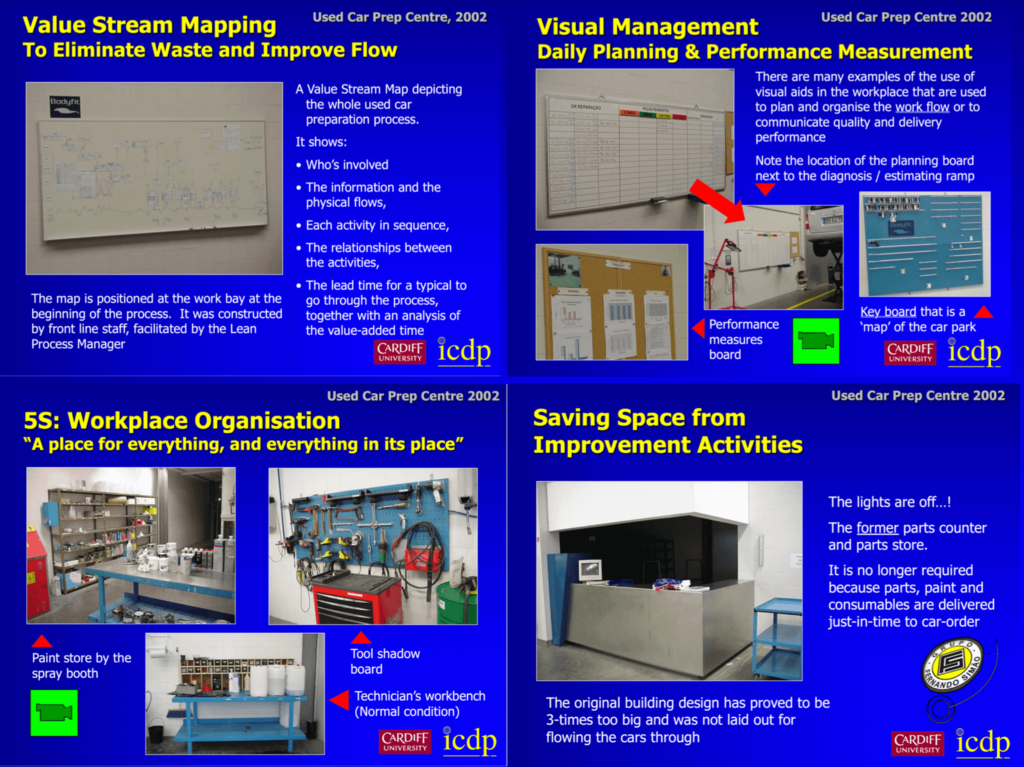

Over the next few years, I spent a week per year visiting Simao’s operations. He was systematic in applying lean thinking to parts. His just in time parts delivery freed up space in the dealer and improved technician productivity in service and repair because parts were delivered to technicians in their work bays. In addition, consumable use was standardised and controlled. Quality improvement and cost reduction at the same time.

- Leader has to “get it”

- Pareto principle

- Predictable and unpredictable – flow

- Engineers get this better than sales people

- Link sales and after-sales

- Lean parts

- Customer account management

Porsche Cars (GB)

In parallel with the work at Simao, Dan was contacted by the Finance Director of Porsche Cars GB. Porsche had used former Toyota veterans to turn around the German carmaker. Porsche Verbessrungs Process (PVP) was their internal term for the initiative. They had great success in new product development, production and supplier management. Now, Wendelin Wiederking, the CEO, wanted to apply their improvement process to the National Sales Companies and the Porsche owned dealerships.

Dan asked that I go and talk to Porsche. We agreed I would work as an employee, 3 days per week as PVP Manager and continue to do research for Dan on the other 2 days. This was perfect timing. Dan and Jim Womack were working on their next book. It would become Lean Solutions. We wanted customer orientated cases. What better way than to extend the Porsche case. However, not everything in life pans out right first time, on time.

Measuring Customer Fulfilment

I arrived at Porsche in January 2001. The ICDP research and the Simao work were “successful.” Therefore, it felt obvious to start there. I spent the first couple of weeks explaining customer fulfilment and then recording it in Porsche’s West London dealership in Chiswick. There are two reflections. The first was that management weren’t interested in customer fulfilment. They were interested in financial performance. Secondly, like most of the industry they measured customer satisfaction, not fulfilment. For those unaware customer satisfaction is nearly always a sample and it’s based on a likert scale – poor, fair good, very good, excellent. These days it’s been replaced by net promoter scores – the question “would you recommend…?” Both are necessary, but not sufficient to develop problem solving capability to create value for customers.

I tracked customer fulfilment – was every car completed by the after sales team right first time, and delivered on time to the customer? The results were shocking. In the first week 37% of customers had a car delivered right first time, on time. Yes, 37% – but customer satisfaction was in the high 80 percent mark. The target was around 90% – and that’s what the bonuses were built on. The team weren’t aligned to solving the repeat problems that just kept occurring. Instead, I heard that we could achieve higher satisfaction scores by changing the way service advisors asked for feedback, by being vague about handover promises and by managing expectations. The managers weren’t wrong. This was a well operated, traditional machine. It just wasn’t lean.

From Convincing to Engaging

A great example occurred when we were improving the used car process. We had a 90 minute takt time and were doubling production, moving to a 45 minute takt (yes there was so much waste in the process, that this was possible in one leap!) To do so we wanted to change the inspection process and wanted to put geometry equipment onto the ramp we inspected the cars on. It was an obvious improvement, one which had management been gemba focussed they would have nodded and said, get on with it. In contrast, we needed a powerpoint presentation that had to be presented at the next exec meeting. The cost of the equipment we needed was £750.

Porsche Reflections

- The problems to solve have to be clear – they have to have a clear purpose.

- Understanding the performance of the key processes in delivering value for customers is key.

- Leaders must “go and see.”

- Focus on financials is not enough – providing customer value means understanding the work.

- Good operations management starts with demand.

- Improvement has to be built into the management system, not be the responsibility of the corporate lean team.

- What does management have to do to sustain and improve their systems.

Through the course of my 4 years at Porsche we improved a lot. Financially we were very successful. But the example wasn’t good enough to write up as a lean car retail case in Lean Solutions. Instead, we used the Simao case that I had continued to work on away from Porsche. It illustrated what was needed to radically change the performance of delivering customer value and illustrated step changes in the key dealer value streams – sales (new and used), after sales, body repair and parts.

Creating Examples of Lean Car Retail & Illustrating the Benefits

During this early period, we focussed on creating examples and illustrating the benefits. The thinking was that the industry would compare performance and would follow the principles. Our aim was to spread Lean Thinking across automotive retail in a similar way to how it was spreading across the wider automotive sector. Car retail would also be lean. We organised visits to the early pioneers for others to see. But, the reality was they rarely did.

I remember one senior executive saying to me “There’s no way these guys (Simao) are making money. There are no cars in the workshop.” The manager’s traditional view was that there needed to be lots of cars on site. If a site was full, it was busy and therefore making money. But look around most workshops and very few cars are actually being “touched.” That is, worked on. Most are waiting idle – either for parts, for a technician, for authority etc. Simao received and worked on cars just-in-time. He limited the work in progress so that most cars were “touched “ (worked on) for the vast majority of the time they were on site. Work (cars and information) flow.

The lean dealer needs less ramps, less space, smaller parts areas and so on. The “traditional manager” just couldn’t knit all these things together. It wasn’t the way he worked and he couldn’t see why or how you’d want to do work this way. It never failed to amaze me that many senior automotive retail leaders weren’t tuned in to the work. We realised we could see within the hour whether they would even try. Astonishingly most won’t and those that do find it hugely challenging.

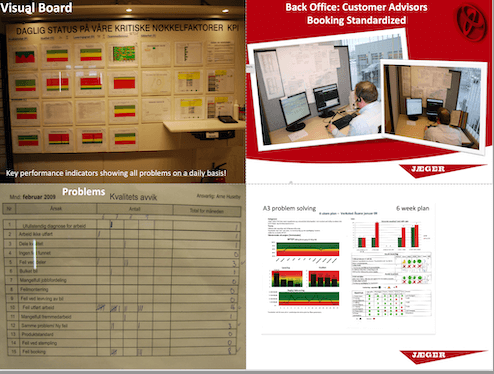

Jaeger Toyota – the leanest Toyota dealer in Europe?

A visit to Simao, did seed our next example. Jaeger Toyota’s MD, Torgeir Halvorsen brought a small team with him to visit Simao in Oporto. Shortly after the visit, in 2006, we developed a pilot case in after sales at their Asana site, just outside Bergen, Norway. The relationship continues to this day. Over the years, the organisation has developed lean thinking across its Toyota business. In after-sales they developed an Express Service process where 2 technicians service a vehicle while the customer waits. They have a pre-diagnosis process to turn unpredictable work into predictable work so that flow improves.

In vehicle preparation they manage the lead time and quality. Both mechanical and cosmetic standards are defined and managed for used cars. This takes place when buying the cars (for example at trade in.) Preparation follows a set flow to a takt time, with work standardised. Vehicles are bought to a profile that best matches the customer demand. All activities are carried out to provide the highest quality vehicle to a customer in the shortest leadtime while improving stock turn and hence freeing up cash.

Lean Sales and a Lean Management System

In sales a similar logic is followed. A standardised process uncovers the most important problems to solve. The process is visualised. Daily performance management meetings are held – it’s about providing value to customers and developing people, at the same time.

All activities are managed through a visual oobeya. In one room senior management can see normal vs abnormal at a glance. In the 17 years that Jaeger have been on their lean journey, not everything has worked. They have (and continue) faced huge challenges – not least remaining profitable while the Norwegian vehicle market shifts to electrification. Toyota has offered limited vehicles of this type which obviously impacts the business.

- The leader starts where they are.

- Go narrow and deep to create your own pilot value stream – you will learn more doing it this way.

- Think through what lean means in the different value streams across the business.

- Knit these together through a clear management system – learning by doing, what it means to manage in a lean way.

- Recognise you are never done. New challenges keep coming along, but applying good thinking to each problem allows you to deepen capability.

The Jaeger case became our new example. We were asked more regularly about applying lean to car retail. In Bergen, (as had happened in Oporto before) Jaeger’s competitors asked for help. When this happened, we had a choice to make. Develop a consulting business around lean dealerships and work with as many dealers and manufacturers as possible or use the work as a test-bed for wider applications of lean thinking and practice beyond the sector. For the work to align with the Lean Enterprise Academy’s purpose, we chose the latter and made a decision to work with one dealer organisation at a time in a market.

Applying lean to more Toyota dealers – now there’s a story!

In 2011 we started working with Halfway Toyota in South Africa and Botswana. The case is well documented as there are several talks on our YouTube Channel and a number of articles on LGN’s Planet Lean website. The work presented a unique opportunity to work with a former Toyota executive to apply lean thinking and practice to the dealer environment. Without reiterating all the research that was conducted, it’s probably best to provide links to the articles that were written up here:

Halfway Articles on Planet Lean

- Terry O’Donoghue brings lean management to car dealerships

- How humility transformed a car dealership in Botswana

- The people-led lean turnaround of a chain of car dealerships

- Growing car sales by 400% in a dealership using lean

- Fast and lean car servicing and repairs in Botswana

- Developing our people to flow value to our customers

- Plus Nine more articles on applying lean to car retailing!

What was interesting about the activity was that experiments took place in 8 dealer sites, and wider Halfway businesses such as the cleaning company, rental company, finance company and insurance organisation. In the dealer sites, each experiment was designed to close a gap or to solve a problem situationally. In addition, across the dealer sites it was possible to modify the approach and/or the sequence of activities. This was done to learn if a best-known way was possible – i.e. a standard could be developed and whether excluding and including elements increased/reduced the likelihood of benefits being realised and sustained.

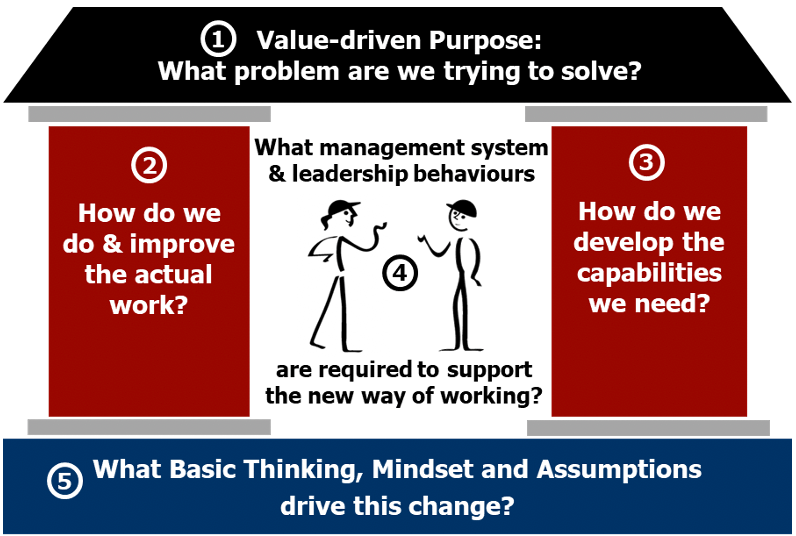

Halfway Research using the Lean Transformation Framework

All the experiments were structured using the Lean Transformation Framework. A significant finding from the work was that the sites that performed best had much better alignment vertically with the framework. Where the activity was more focussed on the horizontal elements: the work; management system; leadership behaviours and capability development – the performance change and sustainability was not as significant as where alignment between the value driven purpose; problem to solve; leadership behaviours; management system and underlying thinking took place. The findings didn’t so much result in a “defined sequence” as a standard for the introduction of the concepts and exercises but highlighted the need to define the problem to be solved and identify the gaps to close as a pre-requisite.

Not Everything Works Right First Time

When we started our lean car retail research, our initial question was “could lean thinking be applied to the sector?” The answer is definitive. It has been and can be in the future. However, we answered the research question early in our journey. For the last 20 years the focus has changed. It is no longer a question of “if” lean applies but “how” the industry can do this.

To a large extent, this is in the hands of the industry’s leaders. We’ve seen examples of people who learn lean thinking. They see the connection between it, solving problems and developing their people and organisation. Fundamentally, they have the determination to do it and develop the skill. Quite a few others just don’t get it, irrespective of the seeing the benefits. However, most disappointing to me are those who see the connection, but don’t build the right conditions for it to flourish.

Over the 25 years of doing this research that separates great examples from the ones making quick wins or from the ones who don’t sustain or don’t even bother. The number of times I’ve seen leaders get the principles but fail to deal with the social side of the change – both in their management and front-line teams. For some, the deal is more important than the process. Their position more important than learning, irrespective of what the boss wants.

A key question for the OEMs (vehicle manufacturers) is how do they find partners who will take the things they take for granted in new product development, production operations and the supply chain into their sales and after sales processes?

Conclusions

Will the retail part of the industry adopt robust, scientific thinking? Can it survive if it doesn’t? What will it look like in either case? I suspect the situation won’t be as clear cut as will it or won’t it. I predict some manufacturers will respond effectively to the challenges ahead, some less so. Some dealers will respond, some less so.

Using lean thinking can change the perspective of the problems to solve – from providing cars as products, to providing mobility as a solution to customers’ needs. New problems and challenges occur constantly. The industry faces a number of these simultaneously including:

- Navigating the increased complexity of providing a range of technologies – e.g. ICE, hybrid, electric and hydrogen vehicles.

- Changes in wider consumer behaviour – e.g. increased on-line browsing and purchasing, the requirement for shorter lead times when ordering consumer goods etc.

- CASE challenges – new areas of “Connected” cars, “Autonomous / Automated” driving, “Shared” use, and “Electric” vehicles.

- The wider use of artificial intelligence to streamline customer journeys.

- The environmental challenge, irrespective of the technology being used.

- With each of the above, a structural shift in where, when, who and how cars are distributed – including the current debates on OEMs selling/leasing vehicles direct to customers and the current agency experiments.

One thing is for sure – there are a range of alternatives to consider and evaluate and we will see situational countermeasures applied. An obvious next step will be closer links between the manufacturer as designer, developer and producer of vehicles and the selling and distribution of them.